China Updates Railway Locomotive HS Codes Export Tax Rebates

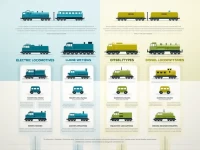

This article provides a detailed analysis of various HS codes for locomotives and their corresponding export tax rebate rates, including types such as electric and diesel locomotives. The information helps businesses enhance their market understanding, optimize goods trading processes, and refine export strategies to improve competitiveness and economic benefits.